Understanding Underused Housing Tax: Avoid Filing Penalties

Givens LLP | March 11, 2023

SHARE

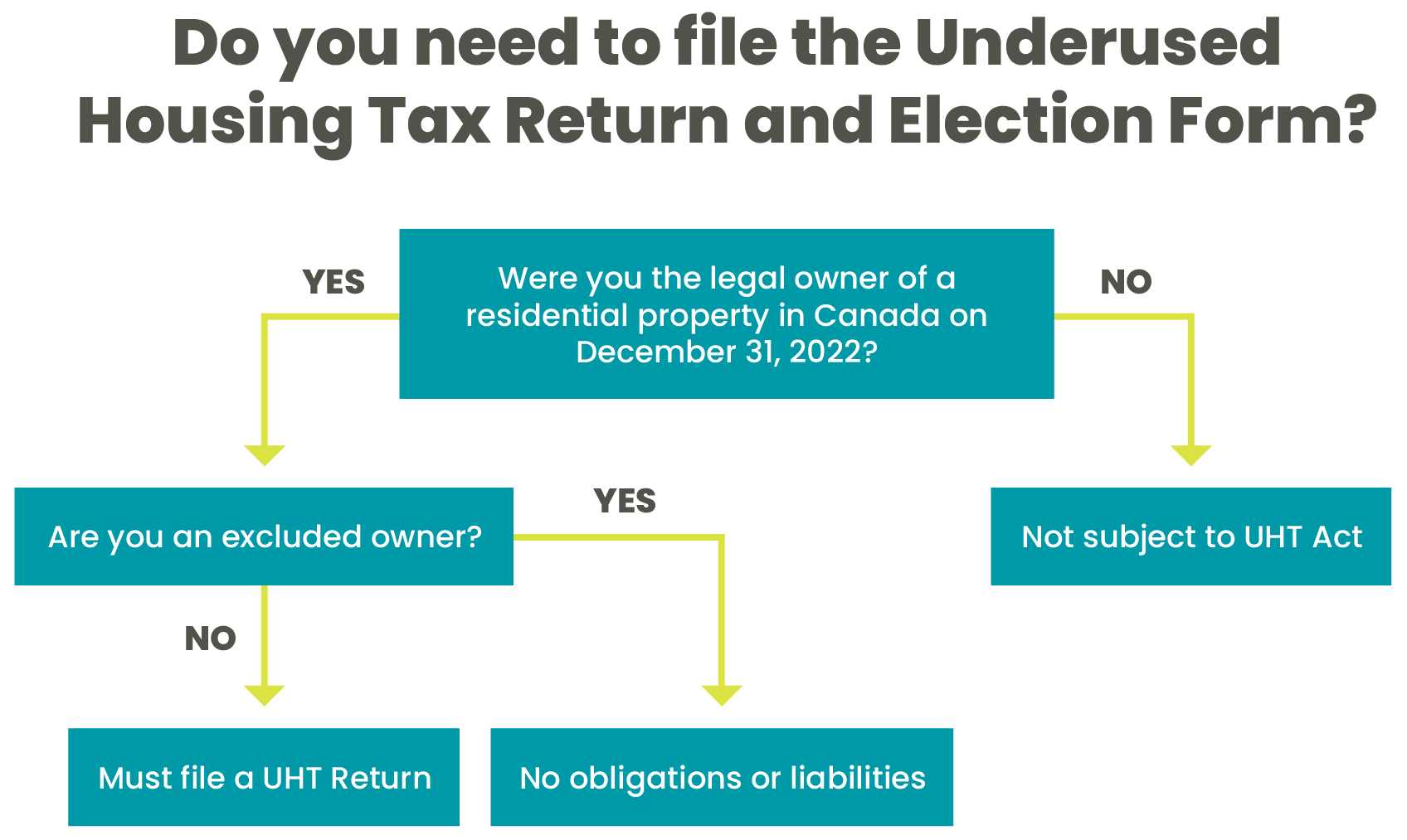

The Underused Housing Tax (UHT) was enacted on June 9, 2022, and is effective retroactive to January 1, 2022. It is meant to deter non-Canadian ownership of residential property from standing vacant. The UHT imposes a 1% annual tax on the value of residential real estate owned on December 31 of each year and considered to be vacant or underused. This tax must be filed and paid by May 1, 2023 (as April 30, 2023 is a Sunday). This filing deadline also applies to corporations with non-calendar year ends.

Even if there are no taxes payable, a UHT form (UHT-2900) may be required to be filed. This form is required for EACH residential property. Late filing penalties are severe, the greater of:

- $10,000 ($5,000 for individuals)

- The sum of:

- 5% of the UHT for the year

- 3% of the UHT for the year multiplied by the number of months the return is late

There are two key definitions are around the requirement to file. The first key definition is “excluded owner.” Excluded owners are not required to file a UHT return and include the following:

- Canadian citizens or permanent residents (with the exception of individuals that hold an interest in property as a partner of a partnership or as a trustee of a trust)

- Government of Canada or a province

- An owner of a residential property as a trustee for specific trusts

- A Canadian corporation whose shares are listed on a Canadian stock exchange designated for Canadian income tax purposes

- A registered charity for Canadian income tax purposes

- A cooperative housing corporation, hospital authority, municipality, para-municipal organization, public college, school authority, or university for GST/HST purposes

- An Indigenous governing body or a corporation wholly owned by an Indigenous governing body

The second definition is residential property, which, for purposes of UHT, is property situated in Canada that is either of the following:

A detached house or similar building that contains not more than three dwelling units, along with any appurtenances and the related land

A semi-detached house, rowhouse unit, residential condominium unit, or other similar premises, along with any common areas or appurtenances and the related land.

- A detached house or similar building that contains not more than three dwelling units, along with any appurtenances and the related land

- A semi-detached house, rowhouse unit, residential condominium unit, or other similar premises, along with any common areas or appurtenances and the related land.

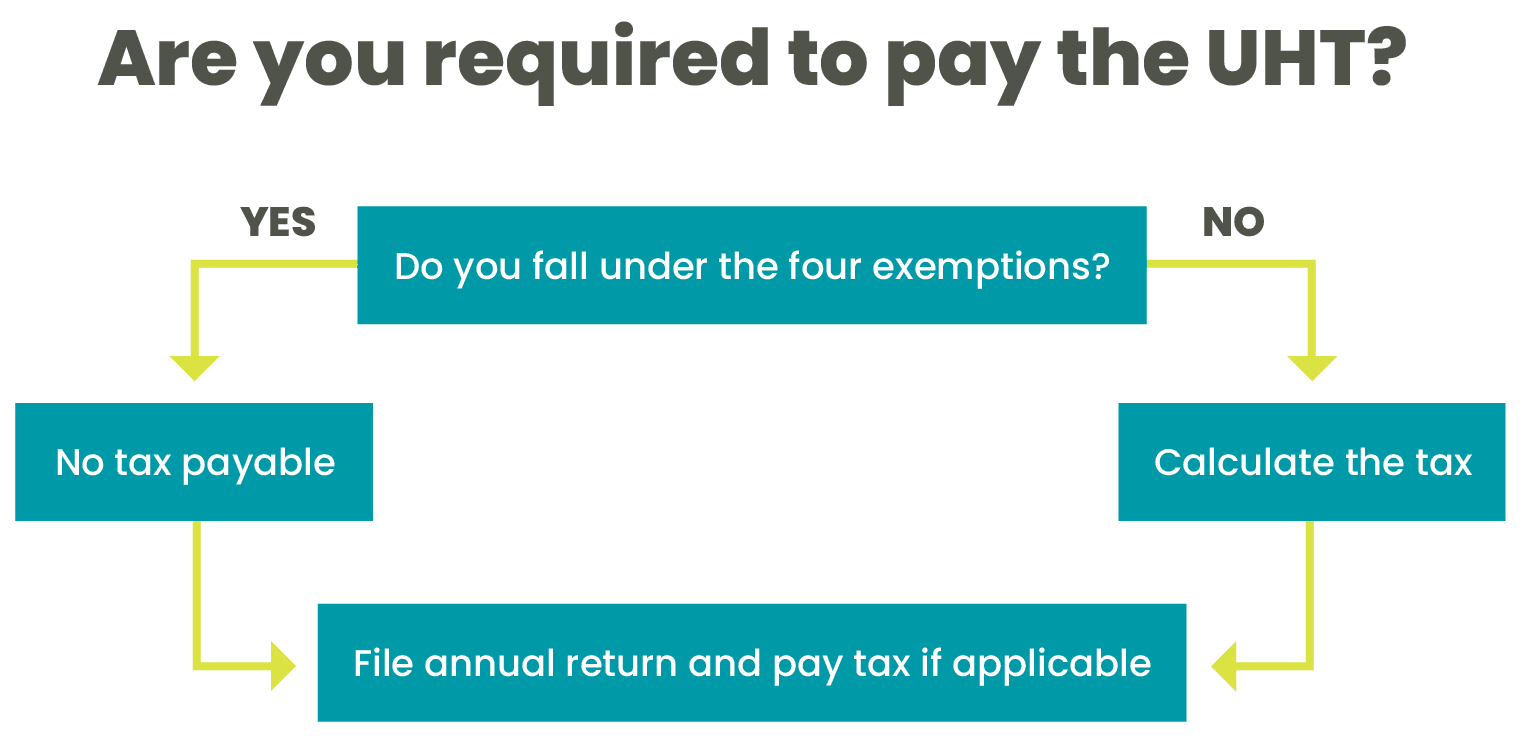

As indicated above, there are four categories of exemptions.

- Type of owner of the property

- Deceased owners

- Surviving joint owners

- Availability of the property (newly constructed, suitability for year-round living, etc.)

- Occupant of the property

- Primary place of residence

- Qualifying occupancy (i.e. at least 180 days in the year)

- Location and use of the property

- Vacation property in an eligible area of Canada

What is the Tax?

Tax impact - Property value x 1% tax rate x your ownership percentage of the property

- Property value is the higher of its assessed taxable value or

- Its most recent sale price on or before December 31 of the calendar year

- You have the option to use fair market value but must file an election with CRA and provide a professionally prepared appraisal of the property

- Ownership percentages used in the calculation must match those registered with land titles

Sample calculation – your property’s value is $549,000, and you own 50% - $549,000 x 1% x 50% = $2,745

Additional Notes

- AirBnB – in computing the 180 days, CRA excludes rentals that are for less than one month at a time. So even if rented out for >180 days in the year, none of those days may count if rented out for less than one month at a time.

- Laneway houses are deemed residential properties